Trends That Will Be Visible in Real Estate Post COVID-19

The third decade of the 21st century opened up to a world that has been forced into a sharp introspection. Strangely, this has often been the case at the beginning of several decades in the past. Whether the 90s which started with the disintegration of the USSR and the consequent unsettling of the world order, or the ‘noughties’ which began with the ‘war on terror’ and the resultant economic upheavals; or even the last decade, which began in the aftermath of the global financial crisis. Each presented an impenetrable smokescreen through which it was impossible to probe or forecast the events on the other side. Year 2020, too, has compelled the world to revisit many of its unshakable beliefs and truths. However, the setbacks this time are of much greater magnitude, and arguably deeper than in the recent past.

In the realm of real estate, both traditional and emergent beliefs have been shaken. For example, the belief that technology will continue to enable densification of offices or that flexi-spaces will cannibalize a large portion of traditional office, have been severely dented, even if it means for the short term. We take a quick look at the broad trends which are likely to be visible in due course.

Digitisation

There is little doubt that the lockdown would have been immeasurably tough but for the availability of digitized economy. Though at a nascent stage, the sharp proliferation of telemedicine, payment gateways, ecommerce, etc., contributed significantly in keeping public services afloat. This was the first time that the world had to deal, on such a massive scale, with remote working, distance-learning, e-meetings, etc. The crisis has unwittingly shown that there are varied as well as cost-effective ways to conduct human activity. The world has now stepped into a zone of digital-irreversibility. Accordingly, real estate will also feel the impact of it, whether in transactions, capital deployment, property management, or even the consumption patterns. Although social activity cannot be conducted in isolation in the foreseeable future, the quantum and scale of real estate consumption may change and may be required to account for the ‘space’ it has ceded to ‘digital estate’

It is extremely difficult to predict the path of recovery, when wading through a catastrophe. The good news is that finding a solution to this massive health crisis from the scientific community has started to become palpable. The next reality that one needs to deal with is the inherent capacities of companies worldwide—more precisely—the capital that fuels their businesses. As of now, most banks and funds have held their own, unlike in the global financial crisis, when the crisis was precipitated by imprudence in the financial sector. If the two realities—scientific solution to COVID and business preservation—remain in sync, the only path should be upward. While the June 2020 update of IMF’s World Economic Outlook painted a worrisome picture, its recovery chart, at least for emerging economies, conveyed a strong recovery phase. So, the second trend to watch out post COVID will be sharp recoveries in emerging economies. This may not be uniformly distributed across sectors. In real estate, retail and hospitality segments are unlikely to witness a V-shaped recovery. The conventional workspace should be on the path to recovery as it had demonstrated a significant momentum for two consecutive years in 2018 and 2019. Offices will continue to flourish albeit with revised space-norms and often in locations that are different than the current patterns. With the current decade belonging to frontier technology such as artificial intelligence, machine learning, data science and big data analytics, the drive for office consumption is likely to take a steep upward curve notwithstanding the emergence of work-from-home during this pandemic.

Strong interest in stable, less-pompous real estate

There are unmistakable signs of India’s renewed focus on its secondary sector. In the last half a decade, the country has been diligently working on growing its manufacturing. With a series of initiatives or reforms, such as Make In India or recalibration of tax rates for new manufacturing companies (in September 2019), the foundations have been laid. Indeed, the one segment of real estate which remains most positive in the long-term is the warehousing and industrial. The growth trend of this segment is expected to be the sharpest post COVID.

Emergence of rental housing

Housing consumption remains one of the main causalities with the rise in unemployment worldwide, eventually disturbing the financial stabilities of many families. However, post COVID or when it becomes a manageable menace, the stabilization of incomes will happen in due course. The interest in housing is likely to rise again. The large-scale housing shortage in India is still evident despite the progress of ‘Housing for All’ initiative. A radical development is the introduction of affordable rental housing complexes for urban migrant and poor. It could lead to a widespread solution for housing woes and an emergence of rental housing in India over the next three-four years. While the policy is only meant to create rental housing for urban poor, it has the potential to lay the foundations for large-scale rental housing for various other classes in future.

source:

Similar Topics

US Election Race Intensifies: How Results Could Impact Nigeria’s Real Estate Market As the...

a month ago Read MoreEquatorial Guinea Official Baltasar Engonga Ebang’s Video Sparks Controversy In recent days,...

a month ago Read MoreNigeria’s digital real estate company, Sytemap, has raised concerns over the ongoing trust...

2 months ago Read MoreGovernor Babajide Sanwo-Olu of Lagos State has urged for more investment to address the persistent...

2 months ago Read MoreHousing sector stakeholders have raised concerns that the rising interest rates in the country are...

2 months ago Read MoreLagos State Governor, Babajide Sanwo-Olu, has emphasized the significance of innovation,...

2 months ago Read MoreThe Association of Private Practicing Surveyors of Nigeria (APPSN), a subgroup of the Nigerian...

2 months ago Read MoreNigeria has been admitted into WorldSkills International, marking a historic milestone in the...

3 months ago Read MoreThe Federal Government has launched the Ministry of Finance Incorporated Real Estate Investment...

3 months ago Read MoreThe National Board for Technical Education has inaugurated the Sector Skill Council for...

3 months ago Read MoreThe Environmental Defense Fund has partnered with Africa Practice to combat climate change in...

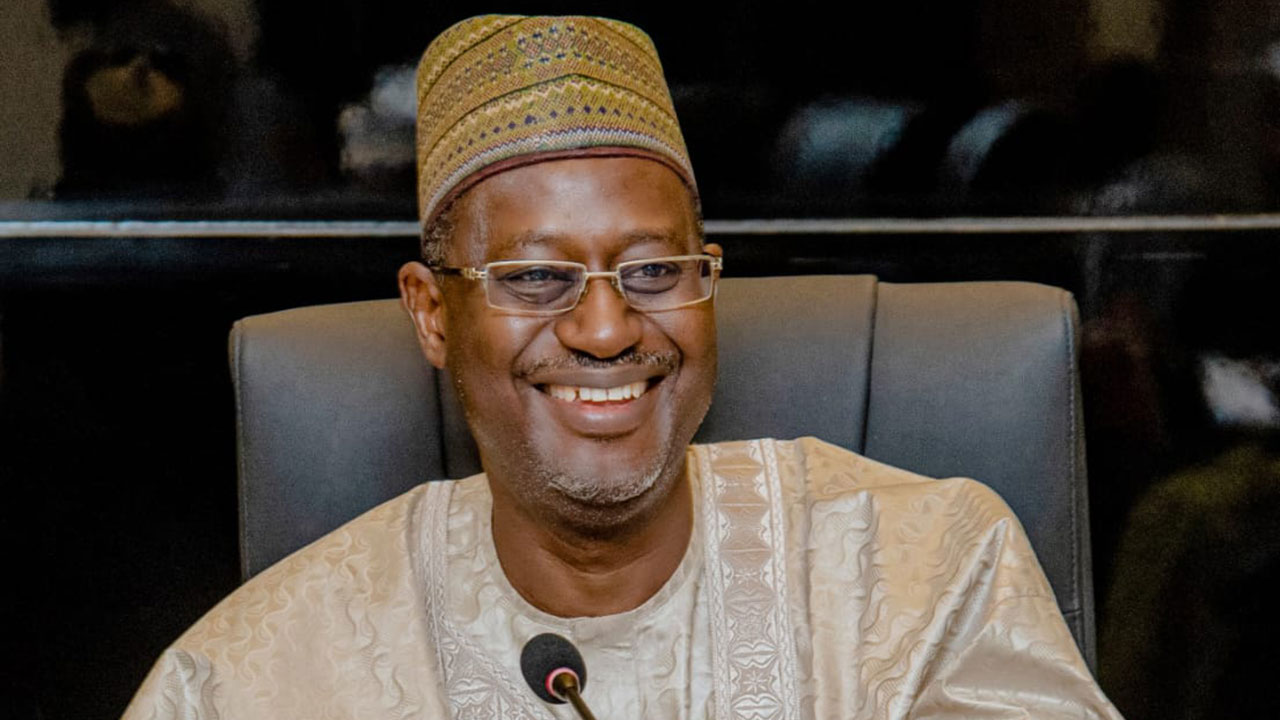

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has reiterated the crucial role of...

3 months ago Read MoreThe Real Estate Developers Association of Nigeria has announced initiatives aimed at enhancing...

3 months ago Read MoreThe Global Environment Facility has approved $3.28m to tackle land degradation in Kebbi State under...

3 months ago Read MoreThe commercial real estate market is currently grappling with several major challenges, including...

3 months ago Read MoreReal estate development is a key driver of economic growth in any region, and Africa is no...

3 months ago Read MoreThe Federal Government has signed a Memorandum of Understanding with Shelter Afrique...

3 months ago Read MoreThe Federal Government has issued a 90-day deadline for subscribers of the National Housing...

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has disclosed that plans are underway...

4 months ago Read MoreA real estate firm, Gestpoint Nigeria Limited, has implored the Federal Government to simplify the...

4 months ago Read More