Nine major issues affecting Real Estate Industry in Nigeria

In the real estate industry Nigeria is experiencing rapid urbanization, with an estimated annual national population growth rate of just over 2% and an annual urban population growth rate of about 4%. The population is becoming more and more focused to the urban areas, towns and cities with just under 50% of the population living in urban areas — and this number will continue to grow. This is one of the factors responsible for the viability of the real estate industry.

But despite these encouraging figures and trends, the Nigeria real estate industry is still burdened by several issues that are hindering its growth. These issues affecting the Nigeria real estate industry is the focus of this article. We will be looking at the top 10 issues affecting the Nigeria real estate industry in no particular order.

- Land Registration Bureaucratic Process

Top on the list of issues affecting Nigeria real estate industry is the bureaucratic process of land registration. Nigeria is among the worst globally when it comes to registering property, according to the World Bank’s Doing Business 2013 report, which ranks it 182nd out of 185 countries. The registration process can last as long as 6 months to 2 years, taking an average of 12 procedures, and costing about 20.8% of the value of the property.

The lackadaisical attitude to work is the major cause of undue delay at the land registry. Oftentimes, a developer’s application would pass from office to office over several weeks and by the time the necessary approval is obtained, he may have lost his source of funding or incurred huge interest on loan obtained for development.

Hopefully, the new comprehensive Second Lagos State Development Plan (LSDP), adopted in 2013, aims to streamline the regulatory environment and improve incentives for private investment and business; for example, land registration initiatives, the creation of GIS maps and the piloting of an e-approval system for development permits.

- High Cost of property development

Building a house is very expensive in Nigeria. A three-bedroom house, for example, will cost about US$50,000, compared to US$36,000 in South Africa and US$26,000 in India, according to the former Finance Minister Ngozi Okonjo-Iweala.

The cost of construction is high for three reasons: high costs of building materials, high skilled labour costs, and costs associated with poor roads and sewerage systems.

About 75% of dwellings in Nigeria’s urban areas are built of concrete. Cement prices in Nigeria are about 30-40% higher than in neighboring countries and world market prices. The lack of public infrastructure adds as much as 30% to the total costs of the development.

- Collapsing Buildings

Building collapses is also one of the top issues affecting Nigeria real estate industry. From 1974 – 2010 as a result of over 60 building collapse in Nigeria, 401 people have died and several more haven’t been reported or accounted for.

Nigeria is so blessed as a nation that we rarely ever experience natural disasters such as earthquakes, Tsunami, or Tornadoes. But yet, despite the absence of all these collateral damaging natural disasters, our buildings still collapse in Nigeria.

Why? Because of our own man made infrastructural disasters. Since we didn’t have our own natural disasters to bring down our buildings, we simply created our own version through sheer negligence. Privately owned buildings both commercial and residential account for the highest number of collaped building in niegria.

- Bribery and Corruption

Bribery and corruption is also one of the issues affecting Nigeria real estate industry. The Jones Lang LaSalle 2014 – global real estate transparency index places the Nigeria in the “opaque” category of transparency, meaning Nigeria suffers from elements of corruption, lack of fundamental data and poor environmental sustainability programs when building large-scale properties.

Bribery and corruption have a negative effect on the Nigerian real estate sector. There are instances where developers who have not satisfied the preconditions for allocation of land are granted allocation while those who are qualified are denied.

- Taxation

Real estate investors are subjected to multiple taxation, the taxes and levies paid by them include development levy, income tax, building plan approval levy, property tax, land use tax, and we also have cases whereby real estate investors are expected to pay renovation tax whenever they want to renovate their properties.

- Devaluation of the Naira

The recent devaluation of naira is also among the top issues affecting Nigeria real estate industry. This is because the Nigeria construction industry is heavily dependent on foreign importation for the raw materials and equipment they use for construction. With a devalued naira, the cost of purchasing these raw materials and equipment will definitely increase.

As a result of the high costs of doing business, property developers to remain profitable will have to pass on these additional costs incurred to the market. According to industry experts, the estimated rise in the costs of housing is 25% – 35%.

The effect of the naira devaluation would have been much milder if construction materials are produced locally thereby cutting down the cost of construction and in turn making properties more affordable for the average Nigerian.

- Limited Source of Funding

Nigeria possesses all the key factors for real estate investment — a growing middle-class population, growth in consumption, rapid urbanization and a young demographic compared to more mature economies.

Yet, financing remains a problem both for property developers and prospective homeowners. So whether you’re thinking of investment property financing or securing real estate loans for financing a personal home purchase, you will still have to deal with the familiar problem of insufficient capital sooner or later.

This could be attributed to underdevelopment in our mortgage industry as it generated less than 100,000 transactions between 1960 and 2009. According to World Bank Report (2008) the contribution of mortgage finances to Nigeria’s Gross Domestic Product (GDP) is close to negligible with real estate contributing less than 5% and mortgage loans and advances at 0.5% of GDP.

- Lack of Competent Builders/Contractors

There is a dearth of competent and professional builders/ contractors in Nigeria. This is also one of the issues affecting Nigeria real estate industry. Most Nigerian builders/contractors are quacks who place more emphasis on money and the initial mobilization fee instead of getting the right workforce and professionals that will execute the project.

When this becomes the case, the workforce is chosen based on availability and not competence and having the right skills. Experts have blamed incompetent artisans and weak supervision of workmen as one of the major reasons of building collapse

- Omo-Onile

The existence of Omo-Onile especially in the Western part of the country is also part of the issues affecting Nigeria real estate industry. They are a pain in the necks of real estate investors, their activities lead to an increase in labour cost, cost of building materials and finally in the cost of completing a building project.

They demand levy for the foundation of a building, fencing of a land, erection of gate, lintel stage, roofing stage, plastering stage, they levy the builders and artisans, levies are also charged for every building material transported to site. All these are enough reasons to frustrate anybody who wants to invest in real estate.

Source:Nigeriarealestatehub

Similar Topics

US Election Race Intensifies: How Results Could Impact Nigeria’s Real Estate Market As the...

a month ago Read MoreEquatorial Guinea Official Baltasar Engonga Ebang’s Video Sparks Controversy In recent days,...

a month ago Read MoreNigeria’s digital real estate company, Sytemap, has raised concerns over the ongoing trust...

2 months ago Read MoreGovernor Babajide Sanwo-Olu of Lagos State has urged for more investment to address the persistent...

2 months ago Read MoreHousing sector stakeholders have raised concerns that the rising interest rates in the country are...

2 months ago Read MoreLagos State Governor, Babajide Sanwo-Olu, has emphasized the significance of innovation,...

2 months ago Read MoreThe Association of Private Practicing Surveyors of Nigeria (APPSN), a subgroup of the Nigerian...

2 months ago Read MoreNigeria has been admitted into WorldSkills International, marking a historic milestone in the...

3 months ago Read MoreThe Federal Government has launched the Ministry of Finance Incorporated Real Estate Investment...

3 months ago Read MoreThe National Board for Technical Education has inaugurated the Sector Skill Council for...

3 months ago Read MoreThe Environmental Defense Fund has partnered with Africa Practice to combat climate change in...

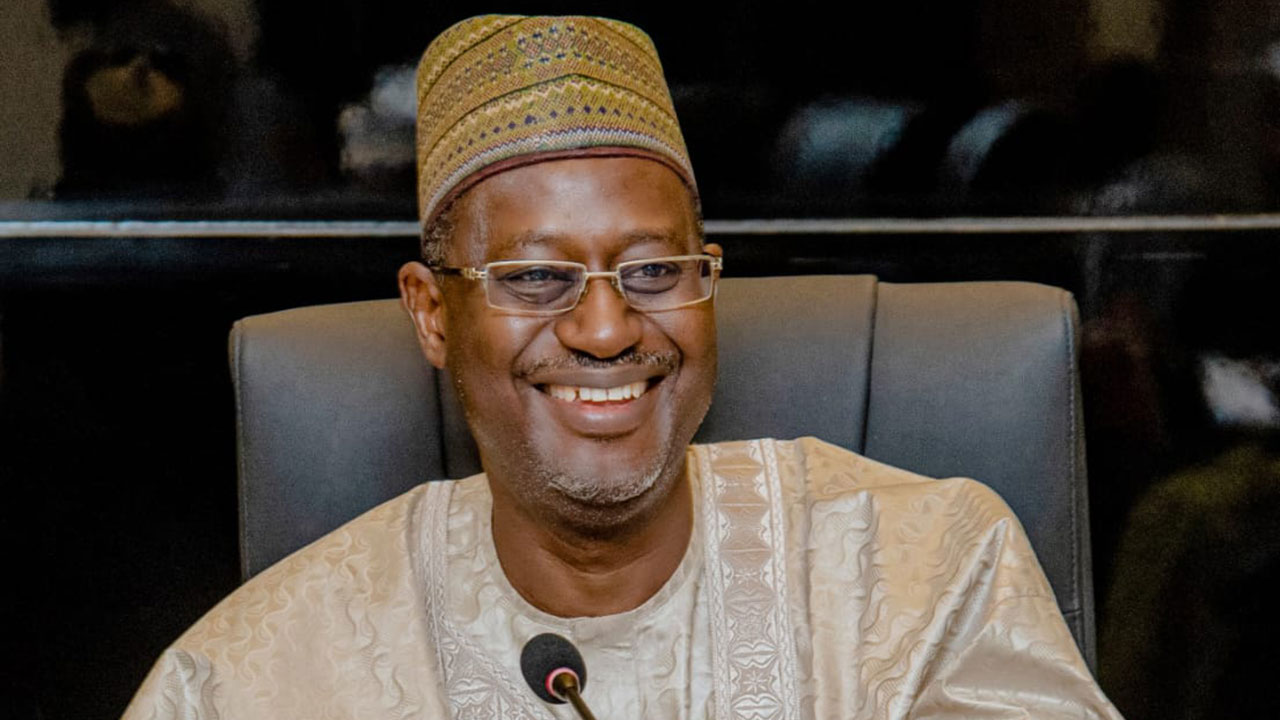

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has reiterated the crucial role of...

3 months ago Read MoreThe Real Estate Developers Association of Nigeria has announced initiatives aimed at enhancing...

3 months ago Read MoreThe Global Environment Facility has approved $3.28m to tackle land degradation in Kebbi State under...

3 months ago Read MoreThe commercial real estate market is currently grappling with several major challenges, including...

3 months ago Read MoreReal estate development is a key driver of economic growth in any region, and Africa is no...

3 months ago Read MoreThe Federal Government has signed a Memorandum of Understanding with Shelter Afrique...

3 months ago Read MoreThe Federal Government has issued a 90-day deadline for subscribers of the National Housing...

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has disclosed that plans are underway...

4 months ago Read MoreA real estate firm, Gestpoint Nigeria Limited, has implored the Federal Government to simplify the...

4 months ago Read More