Future of rental market for landlords and tenants in Nigeria

The real estate sector in Nigeria has recorded tremendous growth over the years and has become a lucrative venture for development firms, and investors alike. However, as Nigeria’s real estate sector continues to evolve, several challenges facing the sector have also hampered it from realizing its true potential.

These challenges range from the constant increase in rent, housing deficit, under-regulation and so much more. All these have made the Nigerian property market a mix of opportunities and challenges that can only be navigated by investors who are optimistic about converting it into a viable long-term profit.

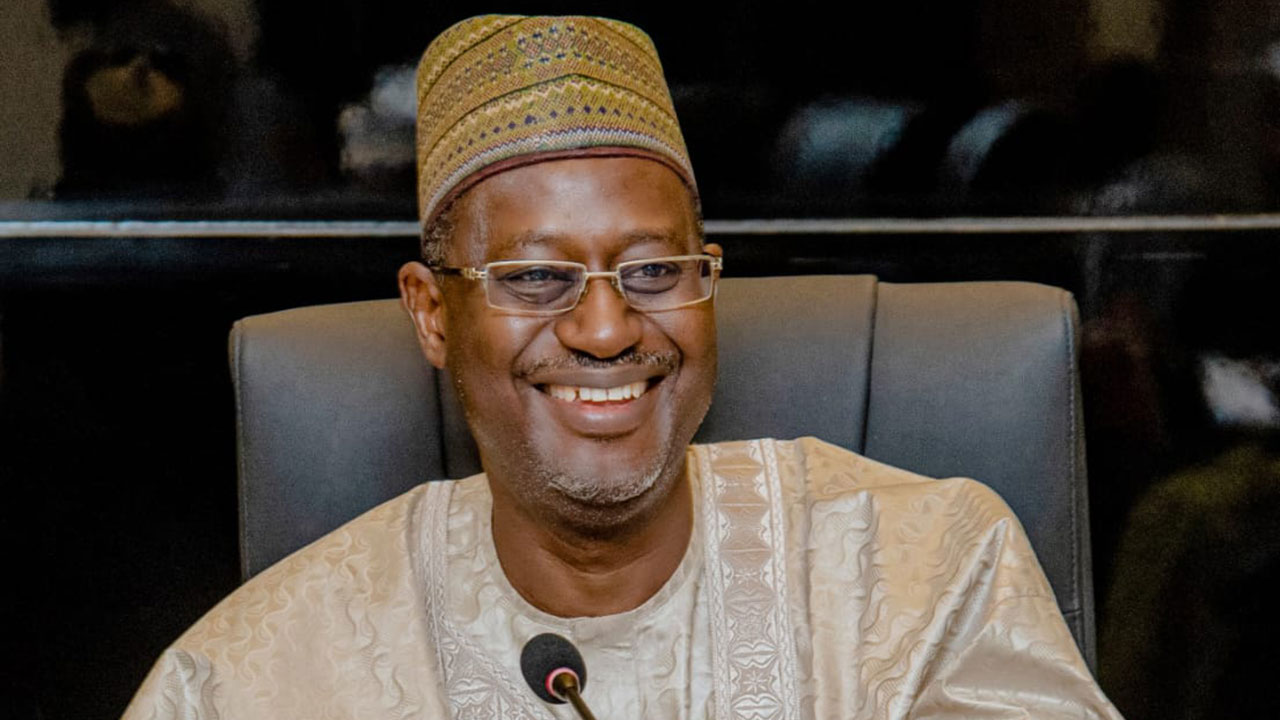

In an exclusive interview with Dailypost, Noah Ibrahim, CEO of Novarick Homes shares insights on the future of the rental market for both landlords and tenants in Nigeria

How have property developers addressed the availability of residential houses in Nigeria so far?

The housing deficit has been a problem for the housing sector for so many years now. Addressing the housing deficit has been a chronic challenge due to a number of reasons, however, property developers are doing a lot in their capacity to ensure housing is available to the populace at a reasonable price.

Access to funds has been a major challenge for developers and many have found off-plan projects, where buyers pay for houses before they are built, as a viable means to finance construction projects. This process slows down the delivery of homes as the developer must find buyers that are willing to pay for the property even before construction can begin. Though it has its shortcomings, it has proved useful, as over 50,000 housing units are developed annually in Nigeria using this means.

For housing to be made available, the aspect of funding needs to be addressed, that is access to loans by commercial banks, and much more; sadly all these are not currently available to most developers. Nonetheless, I would say developers are doing their own bit to make housing available and taking extra measures to ensure they are also affordable.

Do you think houses can really be affordable to the masses, I mean the low-income earners who are the real sufferers of the deficit?

There are lots of factors that contribute to the affordability of a property. These range from the cost of processing the necessary documentation to get approvals to construct, the cost of land, construction materials, labour, power, and several other factors.

Houses can be affordable. But it will require a lot of effort and collaboration to make it possible. The Government will need to put policies in place that support the construction of houses, like Public-private partnerships, where they provide land and the developer builds, rent to own schemes, easy access to mortgage at fair rates and more. While the term affordability is subjective, you will agree that paying a million naira annually for 10 years is a lot more affordable to many than having to cough our 10 million naira to outrightly purchase a property. Our mortgage system will definitely need to be worked on beyond the current exorbitant offerings, so that people can not only access it, but can get a fair rate.

Despite the growth in the number of property developers, both the housing deficit and the vacancy rate is still high, what is responsible for this?

The vacancy rate is on the rise because most people can not afford the properties being constructed or afford to pay high rental fees they command. The two primary factors responsible for these are affordability and demand.

The housing deficit exists because developers are targeting the elites that can afford to pay the full cost of their offlan projects outrightly, as they need these funds to construct. These niche groups have a preference for luxury homes, so to meet their expectations for luxury, developers tend to build more duplexes and mansions and less apartments which ultimately translates to less homes per available land.

When these homes eventually go on rent the bulk of the masses can’t afford them, thus the high vacancy rates. While there are other reasons, I find this the most probable for the high housing deficit and vacancy rate.

So how exactly are property developers addressing the housing deficit and vacancy rate especially in the southwest

While my previous statement holds true, most developers still recognize the potential in affordable housing, so many are looking towards the suburbs where land is still relatively cheap to build mass affordable houses. At Novarick Homes, we are exploring 3D printing technology as a viable option to deliver affordable homes; this technology can optimize the construction process to reduce the cost of construction by over 40 percent, reduce construction waste by over 50 percent and the time it takes to build a unit by over 70 percent.

There are other ways to construct affordable houses. I’ve seen well constructed container houses, and they are quickly becoming popular in the south west. Another alternative is prefabricated materials which may be slightly more expensive but can deliver units at a very fast pace compared to traditional building methods.

Innovative property developers are constantly seeking out new methods and trying to infuse novel innovations into real estate to deliver affordable at fractional time.

With the continuous increase in property prices, where exactly is the real advantage; buying, leasing, or renting

There are advantages in every sector that do not depend on price, just like the two sides to a coin, there will always be investors capable of purchasing properties at any price mark. I always advice people looking to invest in real estate to start small; if you can’t afford to buy a 3-bedroom, go for a two-bedroom or 1-bedroom and it goes on like that. I know people who own properties in Lagos and still rent, one of their properties would be put up for rent, while they still occupy another.

Buying, leasing, or renting all have their own advantages, if you buy to live in your property, that property can be assumed as a liability, however, if you buy to rent, it becomes an asset that you can use as collateral to get more funds to buy more properties. Leasing on the other hand generally applies to commercial projects, this would be ideal because of the high cost of buying the property, it is unavoidable. They all have their advantages depending on what part of the investment circle you look at.

What should potential landlords and tenants expect from the property industry in coming years?

There is so much to expect from the property market. The Federal government, Lagos state government, and the ministers have been speaking on monthly rentals. Monthly rental is the next best thing in the real estate market, it would open the doors for Nigerians and financial institutions to accept mortgages. Once property owners commence monthly rentals, money for the normal yearly rent would be enough to use as a down payment for your mortgage.

With monthly rents, tenants do not have to come up with raising money to pay rent yearly or every two years. However, there is a downside to this, in a country where the economy is to stable, people are getting laid off more often, the cost of living is high so is the rate of inflation, and there is no job security; monthly rent might put people in a very tough position because, once you lose your job, you can’t afford your rent and you do not have a place to stay which in turn leaves more people on the street.

For tenants, there would probably be more flexible policies on tenancy. A lot of the tenancy policies which exist now favor the tenants as opposed to the landlords, but when you bring up monthly rent there would be a shift. The biggest challenge for a landlord is not being able to get the tenants to pay rental fees. So, by the time you start monthly rentals, there is a high chance that the tenant’s equality would change which might be more favorable to the landlords. We are expecting other policies on land ownership and tenancy from the government. We hope something can be done to help the increasing acquisition of property and given tittle

What role can the Government play in moderating the soaring cost of houses and rent?

The government has the biggest role to play in real estate. From providing good infrastructures like access roads etc, encouraging local production of construction materials to reduce the cost, creating easy access to funding for developers and affordable mortgages for home buyers, the list is endless.

The housing sector is currently underserved and is a key reason as to why the housing deficit keeps increasing.. The government itself with all its parastatals in the construction and real estate sector can not single handedly build all the houses the country needs. For this reason, the private sector is needed to contribute in both expertise and capacity, and since they often lack the financial capacity, a reasonable financing system needs to be set aside for them.

Aside from the bank’s absurd interest rates they also require collateral that the developers sometimes can’t produce. For example, if a developer wants to take a loan of a hundred million, the bank needs collateral worth one hundred and twenty million naira before you can access that fund, and they still give you the funds at close to 30 percent interest. By the time the developer pays a 30 percent interest on the money what then is the profit margin on the loan?

All of this would further increase the price of the building. Another thing the government can do is to give individuals a monopoly to import materials for construction or explore similar strategies to assist developers.

Can Technology drive any real change in this sector?

Technology can do so much, infact, technology can solve more than sixty percent of the problems seen in the real estate sector. Let’s look at lands; this particular aspect of real estate sometimes has problems with what is known as “omonile” or not knowing the right full owner of a property is. All these issues can easily be solved with blockchain technology, anywhere you are in the world you know who owns what. Another area is in the ease of documentation and allocation of title documents. These should all be digital by now, with no bureaucracy and delay. Technology in the aspect of 3D printing will make the construction process a lot faster, cheaper and easier. These are just a few areas that technology can solve. In terms of renting, we have observed innovative proptech companies that have websites to communicate availability of rental, Shorlets and co-sharing opportunities as well as monthly rental apartment options.

What are your future plans? How do you see the sector changing in the foreseeable future?

Mortgage, affordability, eco friendly, and also accessibility; are the areas where I see the change in the industry. As for my future plans, its using Novarick Homes to to build and provide more affordable and eco-friendly homes to make as many families as possible homeowners in Lagos, Nigeria, and across Africa as a continent.

Source:Daily post

Similar Topics

US Election Race Intensifies: How Results Could Impact Nigeria’s Real Estate Market As the...

a month ago Read MoreEquatorial Guinea Official Baltasar Engonga Ebang’s Video Sparks Controversy In recent days,...

a month ago Read MoreNigeria’s digital real estate company, Sytemap, has raised concerns over the ongoing trust...

2 months ago Read MoreGovernor Babajide Sanwo-Olu of Lagos State has urged for more investment to address the persistent...

2 months ago Read MoreHousing sector stakeholders have raised concerns that the rising interest rates in the country are...

2 months ago Read MoreLagos State Governor, Babajide Sanwo-Olu, has emphasized the significance of innovation,...

2 months ago Read MoreThe Association of Private Practicing Surveyors of Nigeria (APPSN), a subgroup of the Nigerian...

2 months ago Read MoreNigeria has been admitted into WorldSkills International, marking a historic milestone in the...

3 months ago Read MoreThe Federal Government has launched the Ministry of Finance Incorporated Real Estate Investment...

3 months ago Read MoreThe National Board for Technical Education has inaugurated the Sector Skill Council for...

3 months ago Read MoreThe Environmental Defense Fund has partnered with Africa Practice to combat climate change in...

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has reiterated the crucial role of...

3 months ago Read MoreThe Real Estate Developers Association of Nigeria has announced initiatives aimed at enhancing...

3 months ago Read MoreThe Global Environment Facility has approved $3.28m to tackle land degradation in Kebbi State under...

3 months ago Read MoreThe commercial real estate market is currently grappling with several major challenges, including...

3 months ago Read MoreReal estate development is a key driver of economic growth in any region, and Africa is no...

3 months ago Read MoreThe Federal Government has signed a Memorandum of Understanding with Shelter Afrique...

3 months ago Read MoreThe Federal Government has issued a 90-day deadline for subscribers of the National Housing...

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has disclosed that plans are underway...

4 months ago Read MoreA real estate firm, Gestpoint Nigeria Limited, has implored the Federal Government to simplify the...

4 months ago Read More