Experts Optimistic About Midyear Outlook for Real Estate Sector

“Rental prices for residential properties have increased by an average of 15-20 per cent, while some well-known brands are leaving the country, leading to a drop in industrial footprints. This has however not deterred the continuous investment in real estate developments.”

“This has strengthened the shift towards smaller, local projects and rentals denominated in the local currency (naira) for better financial stability.” For him, the current real estate landscape in Nigeria presents opportunities for foreign investors (FIs) with a long-term perspective, a willingness to innovate, and a suitable risk tolerance level. While the market presents certain challenges, these can be navigated by FIs who adopt a strategic approach. Okosun stressed that the residential sector holds significant potential across its various spectrums. “The substantial housing deficit, coupled with urbanisation and a growing population, creates demand for both affordable housing solutions and premium developments in prime city locations. Beyond residential, the logistics sector offers lucrative potential due to the growing e-commerce industry and overall economic activity.”

“The opportunities nevertheless abound for those who are prepared to strategically traverse the environment and adjust to the shifting dynamics despite these obstacles. Upscale residential projects and commercial assets in major cities are popular investment sites.” He said the major obstacles confronting the industrial real estate market is lack of infrastructure improvements and urbanisation, unstable economic conditions, high operating expenses, red tape and bureaucratic obstacles, and security concerns.

Similar Topics

US Election Race Intensifies: How Results Could Impact Nigeria’s Real Estate Market As the...

a month ago Read MoreEquatorial Guinea Official Baltasar Engonga Ebang’s Video Sparks Controversy In recent days,...

a month ago Read MoreNigeria’s digital real estate company, Sytemap, has raised concerns over the ongoing trust...

2 months ago Read MoreGovernor Babajide Sanwo-Olu of Lagos State has urged for more investment to address the persistent...

2 months ago Read MoreHousing sector stakeholders have raised concerns that the rising interest rates in the country are...

2 months ago Read MoreLagos State Governor, Babajide Sanwo-Olu, has emphasized the significance of innovation,...

2 months ago Read MoreThe Association of Private Practicing Surveyors of Nigeria (APPSN), a subgroup of the Nigerian...

2 months ago Read MoreNigeria has been admitted into WorldSkills International, marking a historic milestone in the...

3 months ago Read MoreThe Federal Government has launched the Ministry of Finance Incorporated Real Estate Investment...

3 months ago Read MoreThe National Board for Technical Education has inaugurated the Sector Skill Council for...

3 months ago Read MoreThe Environmental Defense Fund has partnered with Africa Practice to combat climate change in...

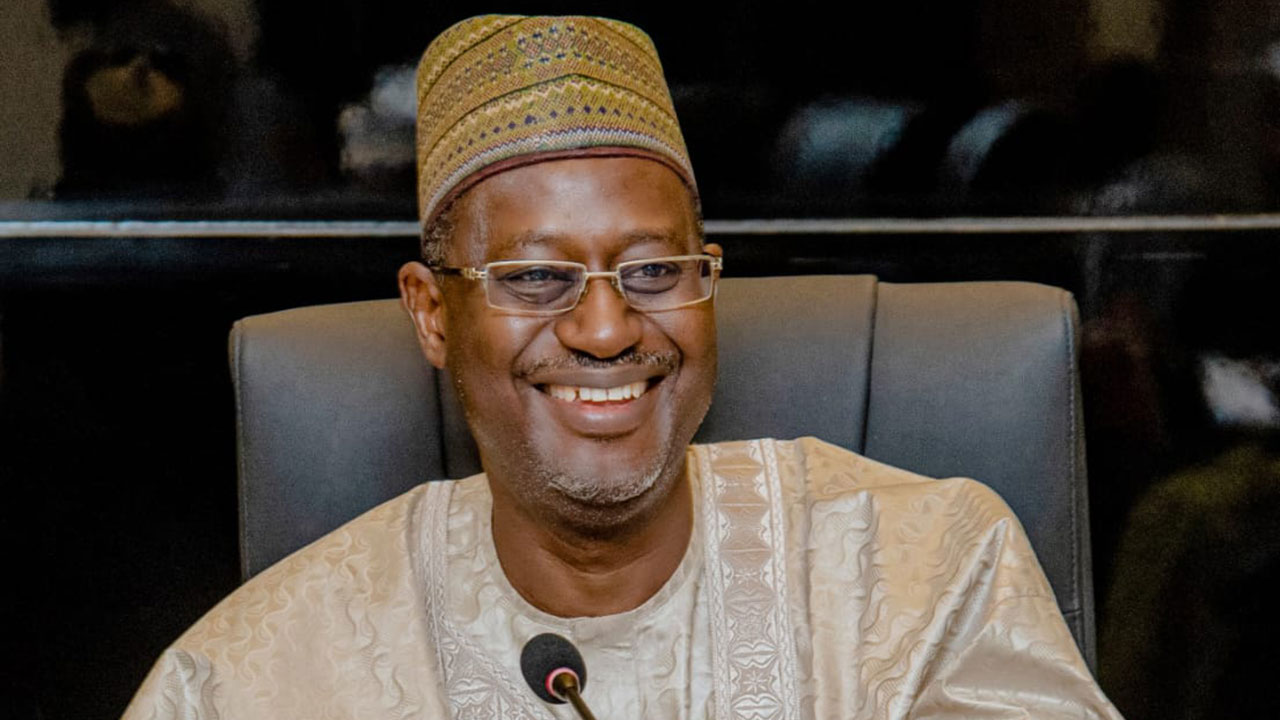

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has reiterated the crucial role of...

3 months ago Read MoreThe Real Estate Developers Association of Nigeria has announced initiatives aimed at enhancing...

3 months ago Read MoreThe Global Environment Facility has approved $3.28m to tackle land degradation in Kebbi State under...

3 months ago Read MoreThe commercial real estate market is currently grappling with several major challenges, including...

3 months ago Read MoreReal estate development is a key driver of economic growth in any region, and Africa is no...

3 months ago Read MoreThe Federal Government has signed a Memorandum of Understanding with Shelter Afrique...

3 months ago Read MoreThe Federal Government has issued a 90-day deadline for subscribers of the National Housing...

3 months ago Read MoreThe Minister of Housing and Urban Development, Ahmed Dangiwa, has disclosed that plans are underway...

4 months ago Read MoreA real estate firm, Gestpoint Nigeria Limited, has implored the Federal Government to simplify the...

4 months ago Read More