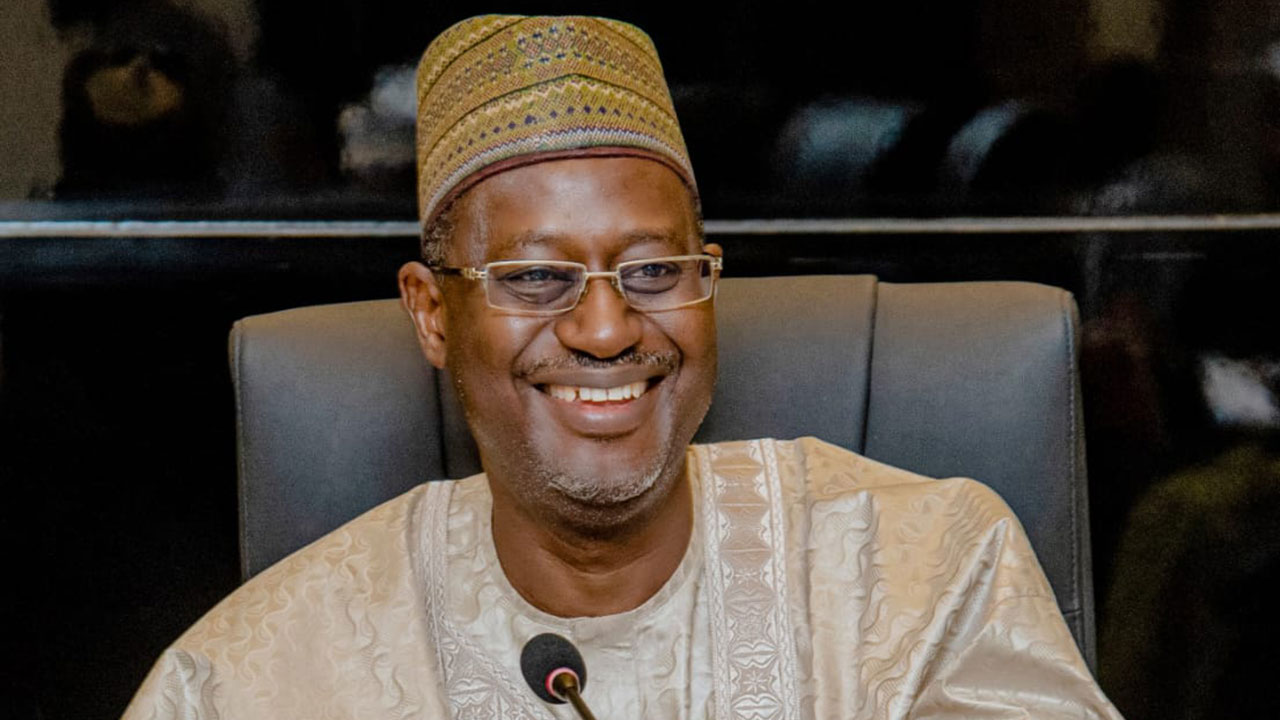

Chairman, Royal Institution of Chartered Surveyors (RICS) Nigeria Group, Gbenga Ismail (left); moderator/partner, Estatelinks Ltd, Adejumoke Akure; Chairman, Nigerian Institution of Estate Surveyors and Valuers (NIESV)Lagos State Branch, Adedotun Bamigbola Executive Director, The Ben Enwonwu Foundation, Mr. Oliver Enwonwu and Vice Chairman, Estate Surveyors & Valuers Registration Board of Nigeria (ESVARBON), Victor Alonge during the summit organized by the Lagos State branch.

With the expected Compound Annual Growth Rate (CAGR) in the real estate sector put at 13.65 percent from 2019 to 2022, experts have advised housing professionals to take advantage of the 2020 budget to reduce housing deficit in the country.

Out of the N2.14 trillion proposed capital expenditure for the 2020 budget, works and housing have the highest capital allocation of 12 percent. While construction and rehabilitation of roads would consume a budget size of N210billion, the federal government national housing and social housing scheme (Family homes fund) will gulp an estimated N17.5 billion and N30 billion respectively.

Despite the challenges of poor access to loan facilities, difficulty in obtaining property titles and high cost of building houses in Nigeria, analysts who spoke to The Guardian, explained that Nigeria will continue to have strong fundamentals in the real estate industry. They urged professionals, especially estate surveyors and valuers to take advantage of the opportunities.

Speaking at the summit, themed “Exploring the present realities for the future” organised by the Lagos State branch of the Nigerian Institution of Estate Surveyors and Valuers (NIESV), a director at Price Water Copper, Bola Adigun disclosed that Nigerian growing middle class, which out-numbers that of any other state in the sub Sahara Africa, the overall population estimated at about 200 million and its seven cities with a population of over one million people presents several possible markets for investors.

She explained, “The growth of real estate is dependent on the health of the economy and if the economy does well, the industry would do well. The private sector should look at ways by which they could partner with the government to ensure that the nation has a sector that is profitable, bankable and working. There are multiple areas by which the real estate operator could benefit from the budget.

“However the major thing is to first understand the market with statistics, saying there are housing deficits of 17 million units. We need to first examine the various strata in the range of upper class, upper-middle class, lower-middle class, and lower class, classify the clientele very well and develop bespoke products to address the needs of specific sectors and customer characteristics. Then, look for how to get government supports through PPP structures to address the housing deficits.”

Adigun was of the view that in real estate, off-take is critical, hence developers need to design products that the market needs and build in relation to their budget. “Professionals could explore emerging finance structures in Nigeria like pre-sales, equity financing, debt financing, mezzanine structure, and public-private partnerships. Professionals can’t just build in isolation, they need to build to meet the needs of the people and keep off the market from been idle and from unoccupied properties”, she warned.

Chairman NIESV Lagos State branch, Adedotun Bamigbola harped on the need to provide leadership in the industry, promote specialization in real estate practice and ensure that practitioners work together for standard and for a business better environment.

“A lot of issues have come out which we are also looking at advising the state government in this respect to ensure that there could better collaboration between the professionals in the industry and ensuring a roadmap for improving development in the industry.

“The issue of the housing deficit is something that needs to be critically dealt with and the approach needs to be defined. The issue of funding of the real estate sector through syndication finance which is out of the conventional loan design is Important because it brings equity and s capital into a project for development.

“N60 billion allocation for the housing sector is not only about the opportunities it offers the housing professionals but the impact that it would have on the existing housing deficit which experts said would make little or no impacts.”

He stated that Nigerian still have a long way to go, if the nation is to recover from the 22million housing units deficits stressing that public private partnership (PPP) is the way forward but maintained that the critical challenge is the accessibility of land in terms of how people get title to lands.

“The Minister of Works and Housing, Babatunde Fashola has proposed recently, a N10 trillion infrastructure bond and the narrative is that if the bond is not engineered by 2020, the following year, the nation might need a N15 trillion infrastructure bond. This means that we are just playing a catch up here and the earlier we get our games right and start moving fast, the better.

“ Government needs to understand that they are not issuing contracts when it comes to PPP, it more of a joint venture and so authorities must give the respect to the fact that some people are bringing in the fund and there is a legal angle to where the funds are coming from”, he said.

Bamigbola said: “Nigeria has to rejig its system and existing laws and there has to be a value reorientation in terms of government recognizing the private sector and it shouldn’t be a master-servant issue but a partnership that guarantees project start that gets to the finish line and not the type that stops mid-way.”

credit: Victor Gbonegun