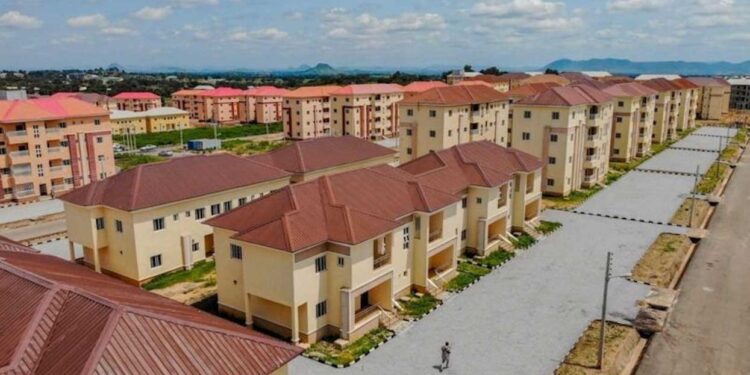

Why most Nigerians can’t access mortgage to own houses

With a housing deficit running into tens of millions, many Nigerians face the challenge of owning their own homes at some point in their lives. Buying or building one are no doubt the available choices, but only a few have the financial power to do so because of the huge capital usually required.

Normally, a mortgage would have been a viable alternative to owning a home, but several factors have made it difficult for most Nigerians to access mortgages.

Some real estate experts, who spoke with Nairametrics in separate interviews, have highlighted these factors that make it difficult for most Nigerians to own a property through a mortgage. According to them, these factors will continue to make access to mortgages a mirage for the average Nigerian.

What experts are saying

The Company Secretary, Living Trust Mortgage Bank Plc, Timothy Gbadeyan, explained that high-interest rate, low wages, and corruption are part of the major factors making it difficult for most Nigerians to access a mortgage to own a house.

According to him, if these challenges are not addressed they would continue to make access to mortgage a mirage for the average Nigerian.

He said, “Accessing mortgage in Nigeria is at an interest rate of around 17% or in some rare cases 16%. If the bank wants to give you N14million and your salary is N120, 000 in a state capital like Osogbo for instance.

“From that N120, 000, your mortgage payment should not exceed N40, 000. What kind of property will you be buying that N40, 000 will be able to service your principal plus interest within a period of 10 years? So when you look at a commercial mortgage as it is. It is outside the reach of the masses.”

Gbadeyan said that the mortgage industry in the Western world is dominated by three players in that cycle. The mortgage brokers, mortgage servicers, and mortgage funders.

“The mortgage brokers are the ones who carry out the pre-qualification. They’re like the marketers, they get all the details and do the needed groundwork and send it to the servicers. The servicers are the ones who will fund the mortgage. They take the due diligence the mortgage brokers have done, do their little checks, and provide the funds.

“The third layer, which comprises the mortgage funders, is like the market itself. The market funds it. They can just go to the market and raise bonds. They have different ways of raising funds. The thing is that our system is different. Here, what the mortgage broker and servicer do is what the mortgage banks do,” he said.

Gbenga Adebowale, another real estate expert, who is a member of the Nigerian Institute of Builders, agrees with Gbadeyan that for many years the industry has not had a mortgage funder.

According to him, it is on this basis that the association of the mortgage bankers met with the Ministry of Finance and there was a lot of engagements that led to the creation of the Nigeria Mortgage Refinance Company (NMRC).

He explained that the NMRC was created as a liquidity vehicle. They are the ones who go to the market to issue bonds and the primary mortgage banks can then request liquidity from them but the situation is still different from what obtains overseas in the sense that for primary mortgage banks to request liquidity from the NMRC, they need to give them a block of perfectible mortgages. They must have created those mortgages for a minimum of six months. Banks cannot also get as many funds as they are looking for. They have to meet a uniform underwriting standard.

“Mortgage is affordable in the Western world because all mortgage rates are single digits. The highest you will get will be in the region of six to seven per cent. This brings more people into the affordability bracket.

“In Nigeria, people fix money with mortgage bank for as high as 12%. Even the NMRC, when they are giving money to banks, their rates are as high as 12%. So, is it possible for any mortgage bank to now give you a mortgage at single digit? It’s impossible. The business of banks is the business of margins, of intermediation,” Adebowale said.

He added that the systemic corruption in the country’s private and public sectors had made the process of obtaining a mortgage, particularly the government-funded mortgage schemes, very difficult.

Source:Nairametrics

Similar Topics

Event Set to Celebrate Managers Who Shape Careers and Drive Organizational Growth Business...

10 days ago Read MoreGlobal Leaders to Converge in Lagos for Landmark Event Driving Urban Innovation and...

10 days ago Read MoreIn a bold move to redefine affordable luxury housing, Nigerian real estate giant Gtext Holdings has...

18 days ago Read MoreIndustry Experts Urge Anti-Corruption Measures, Innovative Financing to Address Crisis By: Oche...

24 days ago Read MoreLAGOS, NIGERIA – Global real estate consultancy Knight Frank and UK developer Mount Anvil...

25 days ago Read MoreBy Oche Onum Lagos, Nigeria As Nigeria’s real estate sector braces for 2025, rapid...

a month ago Read MoreBy Oche Onum Abuja, Nigeria In a landmark move to combat climate vulnerabilities in urban...

a month ago Read MoreLAGOS, NIGERIA The Federal Government announced plans Wednesday to establish a Real Estate...

a month ago Read MoreAccording to The Guardian's investigation, 70% of Nigerian states rely on manual land...

a month ago Read MoreWhat is the Initiative? The Federal Government of Nigeria has unveiled an N100 billion private...

a month ago Read MoreAbuja, Nigeria’s gleaming administrative capital, has long symbolized hope for migrants...

a month ago Read MoreAbuja, Nigeria The Federal Housing Authority (FHA) has suspended all ongoing construction projects...

a month ago Read MoreLagos, Nigeria Amid Nigeria’s escalating housing affordability crisis, real estate...

a month ago Read MoreRenowned Nigerian gospel artist Mercy Chinwo has broken her silence in an emotional video...

a month ago Read MoreThe Nigerian real estate market is projected to hit $2.25 trillion by the end of 2025, according to...

a month ago Read MoreNigeria’s Minister of Housing and Urban Development, Ahmed Dangiwa, has called on...

2 months ago Read MoreAffordable Housing and Luxury Properties Set to Propel Nigeria's Real Estate Market Over the Next...

2 months ago Read MoreHope for improved housing supply in Nigeria may remain unfulfilled, as the 2025 fiscal budget...

2 months ago Read MoreNigeria commemorated its annual Armed Forces Remembrance Day on January 15, honoring military...

2 months ago Read MoreNigeria’s ongoing GDP and CPI rebasing reveal real estate has overtaken oil and gas as the...

2 months ago Read More