Stakeholders optimistic over resumption of FCDA’s land swap scheme

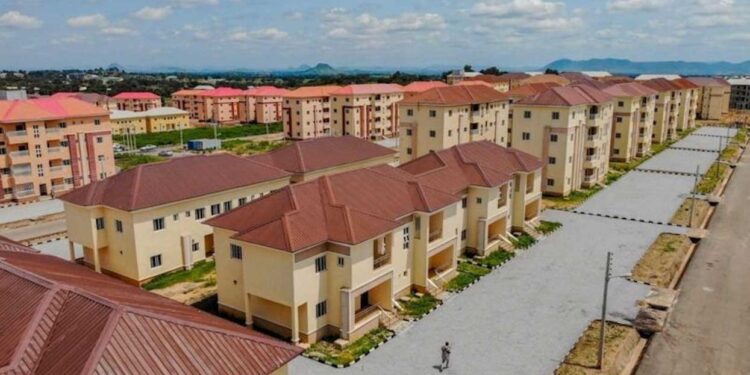

Following the Federal Executive Council (FEC) approval for the resumption of the Federal Capital Development Authority (FCDA) land swap initiative, property developers and government officials are divided over prospects of the scheme.

While some property developers believe that years of suspension have cast a doubt on the programme and devaluation of the naira will escalate cost of infrastructure, others say a new start will boast housing delivery and attract foreign investors.

The initiative worth about N1 trillion initiated under Senator Bala Mohammed-led administration was specifically designed to remedy the infrastructure deficit in the federal capital through swapping land with private investors, who would in turn provide the necessary infrastructure.

Under the scheme, Greenfield lands are granted to real estate developers who would provide infrastructure such as, roads, electricity, potable water, drainages, and sewer lines, communication ducts to residents without any financial or technical demand on the government.

However, the programme suffered a setback after the National Assembly faulted the scheme, saying the initiative was a negation of the provisions of the original Abuja Master Plan as well as a misplacement of priority in the direction of the physical development of the city.

The House of Representatives had argued that if the programme were allowed to materialise, it would only succeed in creating development islands and brazen evidence of uncoordinated development.

Specifically, the land transaction began in 2014 and became controversial. The planned phases and pilot project, which was supposed to have commenced at Katampe District, was halted.

The Guardian learnt that some investors had already paid registration fee of N350 million each, and they were hopeful to get through, but the prospect was stalled midway for lack of clarity.

An estate surveyor and valuer, Adamu Kasim, said the most critical factor that stalled the project was politics accompanied by lack of finance. He said that, on the economic front, at the beginning, the minimum anticipated average investible cost to be borne by the investors per district was about N40 billion each.

“On finance, imagine the volume of investible capital required and ask whether our commercial banks can afford granting such facilities to investors to be recouped within a four year tenor as envisaged by the contract,” Kasim queried.

He said investors took note of the political risks of the project in Nigeria, especially where transitions are likely. He said the government had to take a second look at the project because it was the PDP government that initiated it.

A member of the Real Estate Developers Association of Nigeria (REDAN), Malam Ahmed Goringo, said the land swap in FCT was coming a bit late, seven years after the project was initiated.

Explaining further, Goringo said, at that time it started exchange rate was N150 to one dollar when the FCT requested investors to pay certain amount of money, and “we understand that three or more companies had paid their registration fee to move to sites.”

He added: “Today one dollar is going for almost N500, so it will be very costly for foreign investors to invest in the capital city. Whom are they going to sell the land to because goods and services have gone up?”

“At what value are they going to put the land now because inflation has gone up, and equipment is needed to carry out infrastructure? Government should look into it before embarking on the exercise.

“The starting point matters a great deal, it could be profitable to the public, or for individuals. Therefore, stopping it halfway has become serious issue. This means, we will start the exercise afresh. We hope there will be accountability and transparency.

“The Senate Committee on FCT stalled the exercise after public hearing. When committee conducted a check on all the processes, issues were raised. We thought the money spent was not accounted for when it was suspended. The good thing is that the President has approved the commencement of the project.

“The government has studied it and found out that land swap is a profitable venture, and it will reduce kidnapping and insecurity as well as open up the capital city. People will rush to Abuja for land. The FCTA has done a good thing.”

The Managing Director, System Property Development Consortium Limited, Sanni Zuwedu, said property developers would benefit from the land swap, as it would attract foreign investors and expand new horizon in the built industry as well as offer mass housing to residents.

Giving a history of the exercise, he said: “The arrangement will move finance from the public to the private. You see, no investors gave any money; there were no sharp practices. It was only the transition from one administration that stalled the scheme. We had 26 firms identified as investors, but only seven signed the pact.”

FCT Director of Lands, Adamu Jibrin, said the past government started the project. “When we came, we set up a committee to study the whole exercise to make more inputs. We want to do it in the best interest of the government, real estate developers and the public.

“After that the committee made adjustment to correct the mistakes made. The idea is for developers to provide the infrastructure in the different districts, such as road networks, water, electricity and other amenities.

“The territory has sizeable lands, and we are ready to offer districts, or half of the district to interested developers, provided they fulfill certain criteria, such as bank bonds and capacity to move into sites for development. It will be a win-win situation,” he added.

According to him, the National Assembly investigated the previous land deal, and ordered stoppage because of alleged irregularities, but now government has realised the need to go into public private partnership arrangement to develop the land.

Also, the Coordinator, Abuja Infrastructure Investment Centre (AIIC) Musa Muhammad Kubau, stated that the exercise was on course. “We would do our best to ensure fair play so that investors and developers help to develop the existing districts so as to reduce housing deficit in the country,” he said.

SOURCE: Guardian.ng

Similar Topics

Event Set to Celebrate Managers Who Shape Careers and Drive Organizational Growth Business...

10 days ago Read MoreGlobal Leaders to Converge in Lagos for Landmark Event Driving Urban Innovation and...

10 days ago Read MoreIn a bold move to redefine affordable luxury housing, Nigerian real estate giant Gtext Holdings has...

18 days ago Read MoreIndustry Experts Urge Anti-Corruption Measures, Innovative Financing to Address Crisis By: Oche...

23 days ago Read MoreLAGOS, NIGERIA – Global real estate consultancy Knight Frank and UK developer Mount Anvil...

25 days ago Read MoreBy Oche Onum Lagos, Nigeria As Nigeria’s real estate sector braces for 2025, rapid...

a month ago Read MoreBy Oche Onum Abuja, Nigeria In a landmark move to combat climate vulnerabilities in urban...

a month ago Read MoreLAGOS, NIGERIA The Federal Government announced plans Wednesday to establish a Real Estate...

a month ago Read MoreAccording to The Guardian's investigation, 70% of Nigerian states rely on manual land...

a month ago Read MoreWhat is the Initiative? The Federal Government of Nigeria has unveiled an N100 billion private...

a month ago Read MoreAbuja, Nigeria’s gleaming administrative capital, has long symbolized hope for migrants...

a month ago Read MoreAbuja, Nigeria The Federal Housing Authority (FHA) has suspended all ongoing construction projects...

a month ago Read MoreLagos, Nigeria Amid Nigeria’s escalating housing affordability crisis, real estate...

a month ago Read MoreRenowned Nigerian gospel artist Mercy Chinwo has broken her silence in an emotional video...

a month ago Read MoreThe Nigerian real estate market is projected to hit $2.25 trillion by the end of 2025, according to...

a month ago Read MoreNigeria’s Minister of Housing and Urban Development, Ahmed Dangiwa, has called on...

2 months ago Read MoreAffordable Housing and Luxury Properties Set to Propel Nigeria's Real Estate Market Over the Next...

2 months ago Read MoreHope for improved housing supply in Nigeria may remain unfulfilled, as the 2025 fiscal budget...

2 months ago Read MoreNigeria commemorated its annual Armed Forces Remembrance Day on January 15, honoring military...

2 months ago Read MoreNigeria’s ongoing GDP and CPI rebasing reveal real estate has overtaken oil and gas as the...

2 months ago Read More