According to the NBS data, the credit dropped from the N710bn recorded in the third quarter of 2018 to N588bn out of N16.25tn credit given to the private sector in the same period of 2019.

The amount shows a drop of 17.18 per cent in the banks’ credit to real estate between the two quarters.

Credit to the sector has maintained a downward trend in over one year, with real estate appearing to be the only industry with a downward credit allocation trend when compared with others.

The NBS figures show that the trend became steady in 2018 when it dropped from N784bn in the first quarter to N744bn in the second quarter.

In the third and fourth quarters, it dropped further to N710bn and N622bn respectively.

The trend continued as it dropped to N596bn out of the total loan of N15.21tn extended to the private sector in the first quarter of 2019.

It however recorded a marginal increase of 1.02 per cent when it rose from N582bn in the second quarter to N588 in the third quarter of 2019.

Despite the downward credit trend, the sector’s non-performing loans have dropped significantly within the same period.

Between the third quarter of 2018 and the third quarter of this year, real estate’s non-performing loan in banks dropped from N130.58bn to N56.56bn.

This shows a decline of 56.69 per cent in the non-performing loans which started decreasing from the first quarter of 2018 and maintained the downward trend.

The Director, Real Estate Advisory of Nothcourt Real Estate, Mr Ayo Ibaru, said the drop in the non-performing loans showed that the property market had started stabilising.

He however stated that it was also an indication that banks were as usual being careful with credit to the sector.

“Commercial banks are not famous for giving loans to real estate except in a few cases of well-conceived projects. So, when we hear about non-performing loans dropping, I think it is banks being careful,” he said.

The Senior Partner and Chief Executive Officer of Knight Frank Nigeria, Mr Frank Okosun, in an interview with our correspondent, said the property market had started showing signs of recovery from economic downturn.

“I see a very good situation from the first quarter of next year and the market will bounce back. For now, vacancy has declined from the last quarter of this year and things are improving in every other sector; transactions have been coming up and things have been opening up,” he said.

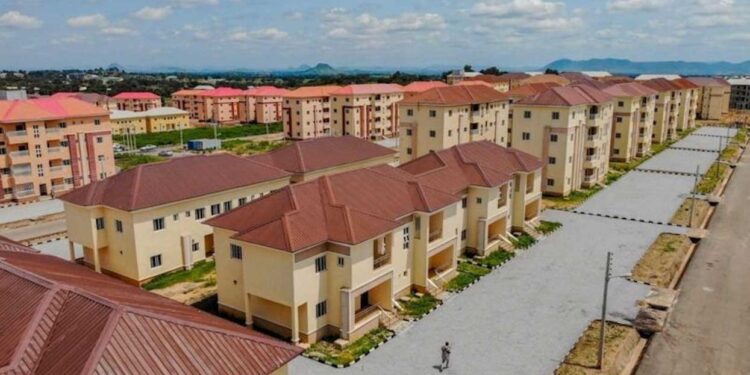

Okosun said there had been a lot of initiatives towards reducing the country’s housing deficit and boosting real estate transactions.

He however stated that more work needed to be done to improve housing provision in the country.

“Shelter is important. The government has to look into that deficit; it is almost about 20 million units and housing delivery is very poor. The government has to come up with a template to see how to improve the market situation,” he added.

He said interest rate on loans should be reduced and more mortgages created so that first-time buyers and the middle class would have access to these facilities.

credit: Maureen Ihua-Maduenyi