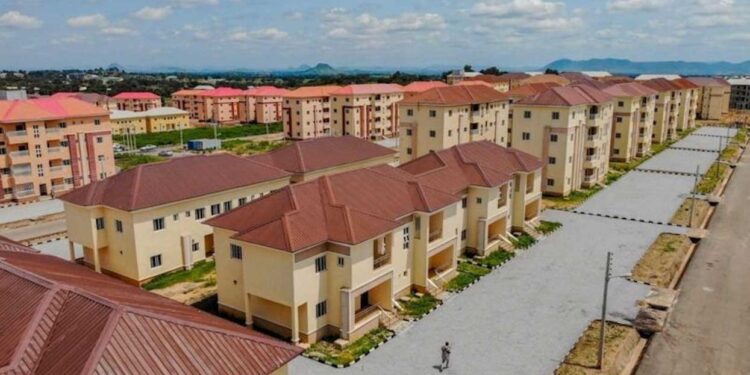

Despite the critical role of shelter to human survival, availability of housing units for a significant number of low- income group of the nation’ s population has remained a challenge.

Housing provision in relation to income has been observed to target more of the middle and upper-income segment forcing over 17 million people to live in slums and rented apartments that are below standard.

The increasing population in urban centres has even created severe problems that result in overcrowding and a situation in which 60per cent of Nigerians could be said to be homeless.

According to World Bank statistics, Nigeria’s population is predicted to hit 206 million by 2020 and 264 million by 2030 crossing the 300 million thresholds around the year 2036. Still, there are no strong efforts by authorities to cushion the effects of ever-expanding population on the low-income earners and limited available infrastructures like; a road, water supply, school and electricity and importantly housing supply.

Over the years, government and private sector have failed to provide affordable housing units to the citizens.

Available statistics indicate that in the last 10-years, housing production still stands at less than a 100, 000 units per year in Nigeria.

While the sector is encumbered by problems inclusive, the unfriendly administrative procedures, high cost of land, securing and registering land title, and failure of mortgage sector to support homeownership dreams of most Nigerians as a result of high-interest rate.

Experts linked the limited number of houses to the huge cost of production, which is often out of the reach to the low-income earners' cadre.

Although, there have been some interventions like the creation of Family Homes Funds which is a partnership between the Federal Ministry of Finance and the Nigerian Sovereign Investment Authority. The Fund has the commitment to facilitate and supply 500, 000 homes and 1.5 million jobs for low-income earners by 2023. This, experts said, is still a drop in the ocean towards housing for all.

Housing which is supposed to be a social contract between citizens and government has been reversed by the government’s inertia to provide sufficient units for all. This has brought about the involvement of the private sector. However, private developers are also facing the constraint of fund and deficits of the needed enabling environment to thrive.

Sequel to this quagmire, the Public-Private Partnership (PPP) model in housing provision was introduced after the 1991 Nigerian National Housing Policy, which supported private sector participation in homes delivery from early 2000. The initiative, thus, gave birth to mass housing schemes in the country.

Notwithstanding the leeway for private sector participation several years after, providers have not lived up to expectations of many Nigerians as the housing deliverables from the players are far beyond.

According to World Bank PPP records, Nigeria has attracted about $10.5bn in PPP investments since 2000. Much of these investments have been concentrated in ports infrastructure with an estimated $7.2bn; followed by electricity, $1.9bn; and natural gas, $679m whereas such initiative in housing has been so low keyed.

Also, the National Bureau of Statistics data, stated that the credit to real estate sector dropped from the N710bn recorded in the third quarter of 2018 to N588bn out of N16.25 trillion credits given to the private sector in the year, 2019.

The amount shows a drop of 17.18 per cent in the banks’ credit to the real estate between the two quarters.

Successful implementation of a (PPP) model for low-income housing seems to have been a fiasco wrapped around its own complexities mostly due to the inability of parties to deliver their own part of the partnership in most cases.

Also, lack of transparency makes it hard for the private sector to make commitments thus, undermines the credibility of the process.

An investigation by The Guardian shows that many of the houses produced under PPP arrangement are often delivered to homeowners at high cost putting to doubt the overall goal of affordability, which a PPP model should deliver.

The investigation also reveals that only few housing units through the model have been delivered in states like Lagos and Ogun where it has been adopted and so no significant contribution has been made in meeting the humongous demand of the urban residents especially in improving affordability.

It was gathered that the smallest housing unit of a two-bedroom terraced bungalow constructed through a PPP arrangement in some estates could go for about N9 million and N12m and sometimes above. This is because the developers are out to make profits from their investment in such a scheme. Whereas; the cost of 2-bedrooms unit in non-PPP housing schemes could be far lesser.

More pathetic is the fact that a low cadre civil servant earning less than N1m yearly would find it hard to own his/her personal home through such scheme even in five years.

Speaking on this, the Chairman, Faculty of real estate consulting, Nigerian institution of Estate Surveyors and Valuers, Niyi Fadoju said, the absence of the ‘right framework’ is the greatest challenge to really make the concept work for housing development.

He said, “The housing is a subsector of the economy so if the disposable income of the consumers is low then what they can buy in the housing market either through mortgage or rent would be minimal. The entire economy has to be deflated for people to have more income. Whatever framework is adopted for housing, if the people lack the income capacity, whichever programme adopted would fail.

“That is the only model that can actually work but what we don’t understand in this country, is the concept of PPP. The difference between public-private partnership when you procure through PPP and the traditional way of procurement is that in the traditional procurement, you procure input but in the PPP, what you procure is output. You just give the specification of what is to be delivered. You don’t tell them to use this or that. For example, I want 200 houses; you don’t specify that they must use the block or any other materials. So we don’t really understand what PPP is and in any case, it is the private developers that have been developing most of the houses we have.” He added.

For, a director at the PricewaterhouseCoopers, PWC, Mrs Bola Adigun, the major challenges of housing Private Public Partnership in Nigeria have been identified to include, lack of transparency in the procurement process and amongst key stakeholders, poor administrative structure, exclusion of low-income earners in the design of the PPP structure and inadequate mechanisms for recovery of the capital investment of the private sector investors

Other failure factors she stated are inappropriate risk allocation, economic conditions and buying power of the middle to low-income earner.

Adigun however, said the critical success factor for housing PPP must include, good governance, transparent and competitive procurement process, technical competence, financial capability and experience and inclusive housing programme.

Also, the Project Director, Arctic Infrastructure (AI), a private organisation with a broad focus on infrastructure delivery, and urban development, Mr Lookman Oshodi, said the area of land administration is key to a successful housing delivery through the model. He said, if we don’t have strong land administration that gives some comfort to the developer for seamless accessibility to land, definitely PPP model for housing would continue to be a very challenging process in the country.

He said in drafting PPP policy for housing, certain indicators must be put in place and must be strictly adhered to, for success especially on the part of the government.

“If a PPP project is to be developed, the stakeholders must be engaged both at the community level, private sector and professional level. If that aspect is certified, then one can see more success. Understanding the funding stream of PPP and what kind of risks would affect the source of funding matters. Funding risks need to be critically analysed and I think policy and law could deal with that in terms of outlining how the funding risks would be mitigated.

Oshodi posited that there is the need to retool the skills of people who are responsible for PPP design for housing on how it is packaged and how it would deliver the goods to residents of any particular city in Nigeria because in most cases, the focus of the developer is usually on themselves and the government and not the people.

“I believed that PPP is one of the fundamental-funding models for infrastructure in different cities especially in developing countries where budgetary allocation to fund infrastructure project is shrinking on a day-to-day basis and on that wise it is ideal. Inputting in place PPP especially for housing, there are quite a number of challenges and paramount is the issue of access to land has remained a major issue for PPP development in cities like Lagos and other cities across the country.

“PPP is not just the way we look at it. It has some key principles, which must include, transparency, accountability, inclusionary aspect and participatory aspects. In most cases, all these are lacking in the way the housing model is structured in Nigeria”, he added.

source: Victor Gbonegun